Tax-exempt Obama Foundation doesn’t exist at listed addresses. Ms Lerner at the IRS ....Fast Tracked this Shady company that Launders Obama Money! She is a criminal and Obama will hide her to hide his dealings!

The “charity” run by President Barack Obama’s half-brother that was fast-tracked for IRS tax-exempt status is based at a Virginia UPS store, according to its website.The organization’s IRS filings list another Virginia address that is actually a drug rehab center where the foundation does not appear ever to have been based.

The Barack H. Obama Foundation is run by Abon’go “Roy” Malik Obama, the half-brother of Barack Obama.

OF COURSE "ABONGO MALIK OBAMA"... SHADY HALF BROTHER OF THE HUSSEIN OBAMA WHO LAUNDERS OBAMA MONEY THROUGH A CHARITY WOULD GET SPEEDY APPROVAL FROM THE "IRRESPONSIBLE REVENUE SERVICE"... THE GESTAPO WING OF THE OBAMA THUGOCRACY!

DEPOSE OBAMA AND HIS CABAL.... HUSSEIN OBAMA IS THE ONE CIRCLED IN THE PHOTOGRAPH... WEARING IS AFRICAN/ARAB OUTFIT....

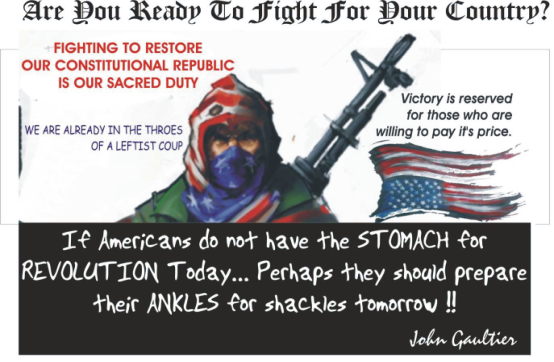

... HOW MUCH MORE SHOULD WE POST UP EVERY DAY BEFORE YOU ALL REALIZE ITS TIME ?? THAT GOES FOR MY BROTHERS IN THE MILITARY.... DOES YOUR OATH MEAN ANYTHING TO YOU ??

Tax-exempt Obama Foundation doesn’t exist at listed addresses. Ms Lerner Fast Tracked this Shady company that Launder Obama Money!

The “charity” run by President Barack Obama’s half-brother that was fast-tracked for IRS tax-exempt status is based at a Virginia UPS store, according to its website.The organization’s IRS filings list another Virginia address that is actually a drug rehab center where the foundation does not appear ever to have been based.

The Barack H. Obama Foundation is run by Abon’go “Roy” Malik Obama, the half-brother of Barack Obama.

Lois Lerner, the senior IRS official at the center of the decision to target tea party groups for burdensome tax scrutiny, signed paperwork granting tax-exempt status to the Barack H. Obama Foundation, a shady charity headed by the president’s half-brother that operated illegally for years.

According to the organization’s filings, Lerner approved the foundation’s tax status within a month of filing, an unprecedented timeline that stands in stark contrast to conservative organizations that have been waiting for more than three years, in some cases, for approval.

Lerner also appears to have broken with the norms of tax-exemption approval by granting retroactive tax-exempt status to Malik Obama’s organization.

The National

Nevertheless, a month later, the Barack H. Obama Foundation had flown through the grueling application

The group’s available paperwork suggests an extremely hurried application and approval process. For example, the group’s 990 filings for 2008 and 2009 were submitted to the IRS on May 30, 2011, and its 2010 filing was submitted on May 23, 2011.

Lerner signed the group’s approval [pdf] on June 26, 2011.

It is illegal to operate for longer than 27 months without an IRS determination and solicit tax-deductible contributions.