TODAY ITS THE OBAMA CABAL... IT COULD WELL BE THE NEXT CONSERVATIVE OR RINO CONSERVATIVE ADMINISTRATION NEXT. SEE THE NAMELESS FOOT SOLDIER BUREAUCRATS IN THE BOWELS OF THE IRS WORK FOR THEIR PAYCHECK AND THEIR MASTERS... ( WHICH EVER PARTY IS IN POWER )

FROM THE HILL:

The Obama administration is refusing to publicly release more than 500 documents on the IRS’s targeting of Tea Party groups.

Twenty months after the IRS scandal broke, there are still many unanswered questions about who was spearheading the agency’s scrutiny of conservative-leaning organizations.

The Hill sought access to government documents that might provide a glimpse of the decision-making through a Freedom of Information Act (FOIA) request.

The Hill asked for 2013 emails and other correspondence between the IRS and the Treasury Inspector General for Tax Administration (TIGTA). The request specifically sought emails from former IRS official Lois Lerner and Treasury officials, including Secretary Jack Lew, while the inspector general was working on its explosive May 2013 report that the IRS used “inappropriate criteria” to review the political activities of tax-exempt groups.

TIGTA opted not to release any of the 512 documents covered by the request, citing various exemptions in the law. The Hill recently appealed the FOIA decision, but TIGTA denied the appeal. TIGTA also declined to comment for this article.

Will anyone be charged?

In its written response to The Hill, TIGTA cited FOIA exemptions ranging from interagency communication to personal privacy. It also claimed it cannot release relevant documents “when interference with the law enforcement proceedings can be reasonably expected.”

Yet, congressional Republicans say there is no evidence of any prosecution in the works, and media outlets have indicated that the Department of Justice and the FBI have already determined that no charges will be filed.

Rep. Jim Jordan (R-Ohio) notes that eight months after Lerner was held in contempt of Congress for not testifying at two hearings, the matter has not yet been referred to a grand jury. The contempt citation is in the hands of Ronald Machen, the U.S. attorney for the District of Columbia who was appointed by President Obama.

Asked for comment on the administration’s FOIA response to The Hill, Jordan said, “It’s par for the course. We’ve had a difficult time getting information from the IRS and the Department of Justice.” Jordan, a senior member of the House Oversight and Government Reform Committee, has held numerous hearings on the IRS scandal.

Last week, Senate Finance Committee Chairman Orrin Hatch (R-Utah) said the IRS recently delivered 86,000 pages of new documents to the panel. Hatch added, “These documents ... were given to us without notice or explanation roughly twenty months after we made our initial document request [on the targeting].”

Republicans in both the House and Senate are stepping up their investigations of the IRS. They have criticized the IRS and TIGTA for not informing Congress about the Tea Party targeting before the 2012 presidential election. GOP lawmakers say the administration has largely stonewalled them, while Democrats have called the probes “a witch hunt.”

Who knew what when?

The crux of the GOP’s IRS targeting investigations is: Who knew what when?

On Friday, May 10, 2013, Lerner famously planted a question at an American Bar Association (ABA) conference where she acknowledged “inappropriate” handling of tax-exempt applications in 2012. Lerner, who has since said she did nothing wrong, released the news before the TIGTA report came out the following week.

The Obama administration considered several other options on how to release the information, including an April conference at Georgetown University and an April 25, 2013, Ways and Means subcommittee hearing. Then-Treasury chief of staff Mark Patterson told Republican investigators that he informed the White House about the IRS plan to disclose the targeting “so that the White House wouldn’t be surprised by the news.”

Soon after Lerner’s comments attracted national attention, White House officials acknowledged they knew about the report but didn’t tell Obama about it.

Lew told Congress he first heard about the IRS matter at a “getting to know you” meeting with TIGTA chief J. Russell George in March 2013. But he said he didn’t learn the full extent of the findings until the media reported Lerner’s remarks at the ABA meeting.

Lew served as White House chief of staff before succeeding Treasury Secretary Timothy Geithner in 2013. Republicans on Capitol Hill are considering asking Geithner questions later this year on what he knew about the IRS’s targeting.

Weekly activity reports

TIGTA sends the Treasury secretary “weekly activity reports” on what it is working on. These reports, which are common in the executive branch and obtained through a FOIA request, serve as a “heads up” to Cabinet heads from inspectors general. They include categories such as “potential or expected press stories,” “upcoming hearings” and TIGTA reports that are awaiting public release.

From January through early May 2013, TIGTA referenced 25 reports that were subsequently issued in the weekly activity reports to Lew. But the agency’s most explosive report was not included in any of these weekly memos. It is unclear why, though a government official pointed out that Lerner spoke about the targeting at the ABA conference before TIGTA released its report. Her comments likely accelerated the Treasury Department’s clearance process.

Regardless, TIGTA officials briefed IRS and Treasury officials in 2012 and 2013, according to TIGTA memos provided to Congress. On May 30, 2012, TIGTA informed then-IRS Commissioner Doug Shulman and his deputies that criteria targeting Tea Party groups “were being used. ...”

Jordan said neither the IRS nor TIGTA informed the Congress at that time — less than six months before the 2012 elections. He also pointed out Shulman didn’t correct his March 22, 2012, testimony to the Ways and Means oversight subcommittee where he said “there is absolutely no targeting” of Tea Party groups.

TIGTA’s FOIA practices have come under criticism before. In the fall of last year, the U.S. District Court for the District of Columbia admonished the agency for its use of FOIA exemptions. Cause of Action, a nonprofit group that has sued TIGTA, announced in December that the agency declined to fork over more than 2,000 documents related to a FOIA request.

Judicial Watch, another group that has sued the Obama administration on FOIA, said in December that the DOJ withheld 832 documents pertaining to meetings between the IRS and the Justice Department’s Public Integrity Section and Election Crimes Division.

Some of the documents that The Hill requested were released to Judicial Watch last year after a judge ruled in favor of the conservative group’s lawsuit.

Attorney General Eric Holder said last week that the DOJ will soon release a report on the IRS targeting that will include “some final recommendations.”

Lerner, who pleaded the Fifth Amendment before Congress, has given a lengthy interview to DOJ officials.

*******************************

We are sliding down a Slippery slide into a feudal Oligarchy ..

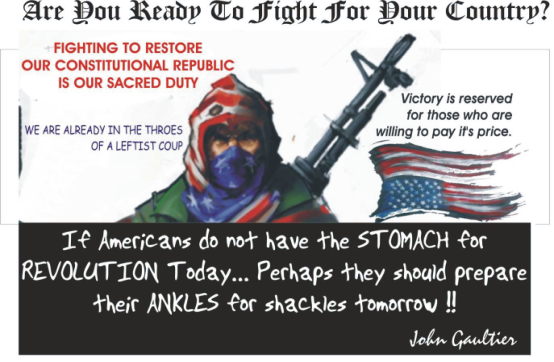

ONLY REVOLUTION WILL CHANGE THE TRAJECTORY!!

ABOUT THE IRS!!

In order to legally and safely beat the IRS it is necessary for you to adopt a certain frame of mind. You need to have a certain independence of mind. You need to be able to read the U.S. Constitution for yourself. You need to be able to recognize how the Supreme Court "judges" and other politicians routinely violate the Constitution. You need to realize that practically all lawyers and accountants are handmaidens of the "terrocrats" - terrorist bureaucrats or coercive government agents. If you cannot already think for yourself, you need to learn to do so. You need to be able to think and do what is contrary to the entrenched among your family and friends. You need to become the authority of your own life. These and related issues are covered in the many other reports.

The Best Kept Secrets of the IRS

- The Sixteenth Amendment, supposedly giving Congress the power to collect income taxes, was never ratified. (For the compelling evidence, get the book The Law That Never Was from Common Sense Press, PO Box 1544, Billings, MT 59103.) Furthermore, the 16th Amendment, even if ratified, is just a smokescreen that doesn't grant any new taxing powers to Congress. The Supreme Court found in 1916 in the case Brushaber v. Union Pacific R.R. Co.; 240 U.S. 1, that the 16th Amendment didn't extend the taxing powers of Congress.

- The Constitution does not empower Congress to delegate any function to the IRS.

- The IRS is apparently a private corporation registered in Delaware.

- The IRS is the Gestapo of the Federal Reserve bankers. The same sponsors pushed the Federal Reserve Act and the Sixteenth Amendment through Congress in 1913.

- The purpose of the IRS is not to collect taxes but to control and terrorize people.

- It is doubtful whether money collected by the IRS goes to the government. Checks received by the IRS seem to be deposited by the Federal Reserve bankers, with "FRB" (for "Federal Reserve Bank") stamped on returned checks.

- Because of the limitations placed by the Constitution on the federal government, the IRS has no jurisdiction in the 50 states.

- The Internal Revenue Code is not law.

- The Internal Revenue Code defines the term "person" in such a way that it does not apply to most Americans.

- For most Americans, the income tax is voluntary.

- The federal income tax is an indirect or excise tax. The end-recipient of income cannot be liable for income tax.

- The term "income" is so defined in the tax code that wages or salaries do not constitute "income."

- Most corporations in America need not subject themselves to the IRS in any way.

- Corporations may only withhold taxes from an employee's earnings if the employee specifically requests such withholding. No one can be legally forced to complete a W4 withholding form.

- Employers who withhold part of the salaries or wages of employees against the will of the latter, commit theft.

- The U.S. Constitution effectively defines "money" as gold and silver - Article I, Section 10: "No State shall make anything but gold and silver coin a tender in payment of debts." The law agrees: "The terms 'lawful money' and "lawful money of the United States' shall be construed to mean gold or silver coin of the United States." (12 USC 152.) The Federal Reserve Note is not money; it is counterfeit currency. Hence receipts in Federal Reserve Notes, having no legal value, are not taxable.

- It may be that most Americans can relinquish their "U.S. Citizenship" and declare themselves State Citizens, subject to neither Federal nor State income taxes.

- There is a legal principle "void for vagueness." The tax code is in many parts so vague that nobody (including IRS terrocrats) can understand it. A 1991 Supreme Court case found that if someone sincerely believes that he or she doesn't have to file a tax return and pay income tax, then that person cannot be convicted of a crime. Several other courts have found accordingly.

- Also in 1991, the Fifth Circuit Court of Appeals held that if someone claims they are not subject to the federal income tax, then the burden to prove the contrary is on the IRS. For most Americans the IRS can't prove this.

- Filing a 1040 or other tax return involves the surrender of the Fifth Amendment right to not incriminate oneself. The Fifth Amendment of the Constitution says that no one can be forced to incriminate himself or herself.

- All IRS liens and seizures are illegal.

- The IRS in its totality is a violent, criminal extortion racket with no legal basis whatsover.

- There are methods for protecting income and assets so that, no matter what the IRS terrocrats do, it becomes difficult for them to violate our unalienable rights to own property and the fruits of our labor. One way is to use Trusts.

- In his book Tax Fraud & Evasion: The War Stories, Attorney Donald W. MacPherson exposes the IRS as a paper tiger. The probability that any individual will be prosecuted for not paying taxes to the IRS are about one in 70,000. The probability that any individual will go to jail for not paying taxes are about one in 146,000. I believe that if you follow the advice in Beat-The-IRS Manual and The Pure Trust Package, the probability of having trouble with the IRS drops close to zero.

Practically everything the Federal Government does is evil, unconstitutional, criminal, and highly destructive. The IRS Gestapo plays a major role in keeping the criminal terrocrats in power. The IRS needs to be eliminated. In the words of Attorney Donald W. MacPherson, "The Beast must be destroyed." What Federal Government we need (if any) can be financed through voluntary exchange for valuable products and services produced, augmented by voluntary contributions.

Please do your patriotic duty. Finance yourself - and worthy causes and institutions of your choice. Are you going to stay in the cattle herd - or join the human race of free sovereign individuals?

"In a recent conversation with an official at the Internal Revenue Service, I was amazed when he told me that, "If the taxpayers of this country discover that the IRS operates on 90% bluff, the entire system will collapse.""

- Senator Henry Bellmon, 1969.

RRR

No comments:

Post a Comment