DEMOCRATS IN Congress Put Pressure on the IRS to Investigate Conservative Tax-Exempt Groups

Over and over, DEMOCRAT members of Congress asked the IRS to scrutinize

501(c)4 groups for their political activity—and also to scrutinize the

agency's scrutiny of those groups.

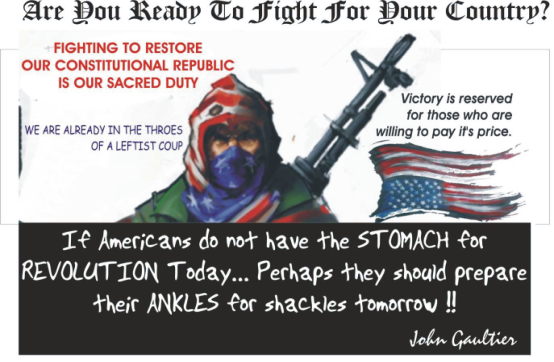

ITS US VERSUS THEM...

ITS US VERSUS THEM...

THEY WANT OUR TAXES BUT THEY DON'T WANT US !! I HOPE YOU UNDERSTAND THIS!!! THEY WANT SLAVES TO FEED THEIR SOCIALIST MACHINE !!

ITS US VERSUS THEM...

WE MUST SAY NO!! REVOLT OR SECEDE..

READ THE DETAILS AND SHARE THE OUTRAGE !!

A report in Roll Call in March 2012 revealed that leading members of Congress not only were aware that the Internal Revenue Service had begun investigating the political activity of would-be 501(c)4 Tea Party groups that winter, but showed to what an extent members of Congress had been actively putting pressure on the agency to take a closer look at tax-exempt conservative organizations in the wake of the Supreme Court's Citizens United ruling. Reported Janie Lorber in 2012:

Tea party outrage over a spate of IRS letters to conservative groups has revived a long-standing dispute over the agency's controversial role in policing politically active nonprofits.Peter Welch is a Democratic congressman from Vermont and sits on the House Oversight and Government Reform Committee chaired by California Republican Darrell Issa. Welch's March 2, 2012 letter to IRS Commissioner Douglas Shulman explicitly called on the IRS to crack down on 501(c)(4)s:

In January, the IRS began sending extensive questionnaires to organizations applying for nonprofit status as part of a broader project to understand whether social welfare organizations—which are not required to disclose their donors—are actually acting as political committees.

Campaign finance reform groups and lawmakers in both parties have repeatedly demanded that the IRS examine the activities of tax-exempt advocacy groups, which proliferated during the 2010 cycle and are on pace to play an even larger role in 2012.

Democrats, whose affiliated outside groups have lost the fundraising race to Republican organizations this year, have been particularly vocal, sending repeated letters to the agency requesting an investigation. On Wednesday, Rep. Peter Welch (D-Vt.) asked his colleagues in Congress to sign yet another.

We write to urge the Internal Revenue Service (IRS) to investigate whether any groups qualifying as social welfare organizations under section 501(c)(4) of the federal tax code are improperly engaged in political campaign activity.In a statement accompanying the letter, Welch's office urged the IRS to "investigate whether nonprofit 501(c)(4) organizations affiliated with Super PACs—such as Crossroads GPS, the Karl Rove-backed group spending millions of dollars in campaigns across the country—are in violation of federal law and IRS regulations."

Congress created a tax break for nonprofit social welfare organizations because communities across our country benefit greatly from their important work. It is clearly contrary to the intent of Congress for organizations supporting a candidate for office or running attack ads against a candidate to receive taxpayer support intended for legitimate nonprofit groups...

We strongly urge you to fully enforce the law and related court rulings that clearly reserve 501(c)(4) tax status for legitimate nonprofit organizations. And we urge you to investigate and stop any abuse of the tax code by groups whose true mission is to influence the outcome of federal elections.

Issa, for his part, sent a letter on March 27, 2012 in concert with Republican Jim Jordan of Ohio, who sits on House Oversight and chairs its Subcommittee on Regulatory Affairs, asking the agency to look into the Tea Party group complaints about excessive information requests.

"Over the past several weeks the Internal Revenue Service (IRS) sent many organizations, operating under tax exempt status, lengthy and detailed questionnaires," Issa and Jordan wrote to Lois Lerner, the director of the Exempt Organizations Division of the IRS, footnoting the above Roll Call story and a report in CNSNews as their sources. "These questionnaires ask for information well beyond the scope of typical disclosures required under IRS Form 1024....[S]everal experts suggest these recent IRS questionnaires exceed appropriate scrutiny."

"Moreover," they added, "the IRS must apply the same criteria for all organizations applying for tax exempt status. News reports, however, indicate that the IRS efforts lack balance, with conservative organizations being the target of the IRS's heightened scrutiny efforts."

A group of 12 Republican U.S. Senators on March 14, 2012 also complained to the IRS about the handling of the Tea Party and other conservative groups. "We have received reports and reviewed information from nonprofit civic organizations in Kentucky, Ohio, Tennessee, and Texas concerning recent IRS inquiries perceived to be excessive," they wrote Commissioner Shulman. "It is critical that the public have confidence that federal tax compliance efforts are pursued in a fair, even-handed, and transparent manner—without regard to politics of any kind. To that end, we write today to seek your assurance that this recent string of inquiries has a sound basis in law and is consistent with the IRS's treatment of tax-exempt organizations across the spectrum."

Signatories on the letter included Orrin Hatch (Utah), Rob Portman (Ohio), Mitch McConnell (Ky.), Chuck Grassley (Iowa), and Rand Paul (Ky.).

Outside groups had been calling on the IRS to investigate non-profits—and especially nonprofit 501(c)(4) groups run by Republican political operatives—since at least the fall of 2011. The "IRS said examining the tax status of 501(c)4 political entities would be a priority for 2012," the Wall Street Journal reported in June 2012, noting that the agency was "taking initial steps to examine whether Crossroads GPS, a pro-Republican group affiliated with Karl Rove, and similar political entities are violating their tax-exempt status by spending too much on partisan activities."

Sen. Max Baucus, Democrat of Montana, called on the IRS in 2010 to investigate tax-exempt groups, writing the IRS commissioner that September to request that the agency "survey major 501(c)(4), (c)(5) and (c)(6) organizations involved in political campaign activity to examine whether they are operated for the organization's intended tax exempt purpose and to ensure that political campaign activity is not the organization's primary activity." He said his request was prompted by news reports about the organizing efforts of conservative groups.

"Possible violation of tax laws should be identified as you conduct this study," Baucus wrote. "Please report back to the Finance Committee as soon as possible with your findings and recommended actions regarding this matter."

On Monday, Baucus announced plans to hold a Senate Finance Committee hearing into Friday's fresh round of revelations that the IRS had targeted conservative 501(c)4 groups.

According to a draft inspector general's audit obtained by the New York Times, the agency use of "tea party" as a key word to scrutinize applicants for tax-exempt status dated to March 2010 and continued through February 2012, when the Tea Party groups began to raise a public outcry.

No comments:

Post a Comment